Visual Design for Future Financial Analytics

Project Category:

Year 2025 Financial Services

Client:

Mercedes-Benz Daimler Financial Services Stuttgart, Germany

Design Technology Used:

Adobe Illustrator & Sketch

Release Date:

Potential for future evaluation

Project Overview:

Conduct the year 2025 design research into financial capabilities and tools used for viewing mechanism.

Problem/Challenge:

This was a visionary approach of how people might experience the auto financing capabilities in 2025. Factors that impacted the strategy included the possible sociological and technical changes of the future, overlapped with today’s technology capability.

Solution/Results:

In the year 2025 the Internet-of-Things (IoT) evolution provides users with ubiquitous information device displays, open operating systems that share information through a Cloud SaaS (Software as a Solution) and dynamic shifts in information communication. In descriptive terms, mobile media is disruptive, engaging, interactive, controversial, and global.

Typography & Visual Color Pattern:

Mobile Presence:

The design is based on responsive mobile development projected over a four-year integration plan:

With all the technology and ideation advancement, the possibility of block-chain technology where financial ledgers are decentralized to lists of all transactions across a peer-to-peer network is the critical cornerstone. This technology provides financial institutions the ability to transfer customer identification value across the internet without a centralized service. The proliferation of technology provides financial institutions new ways and methods to service customer solutions.

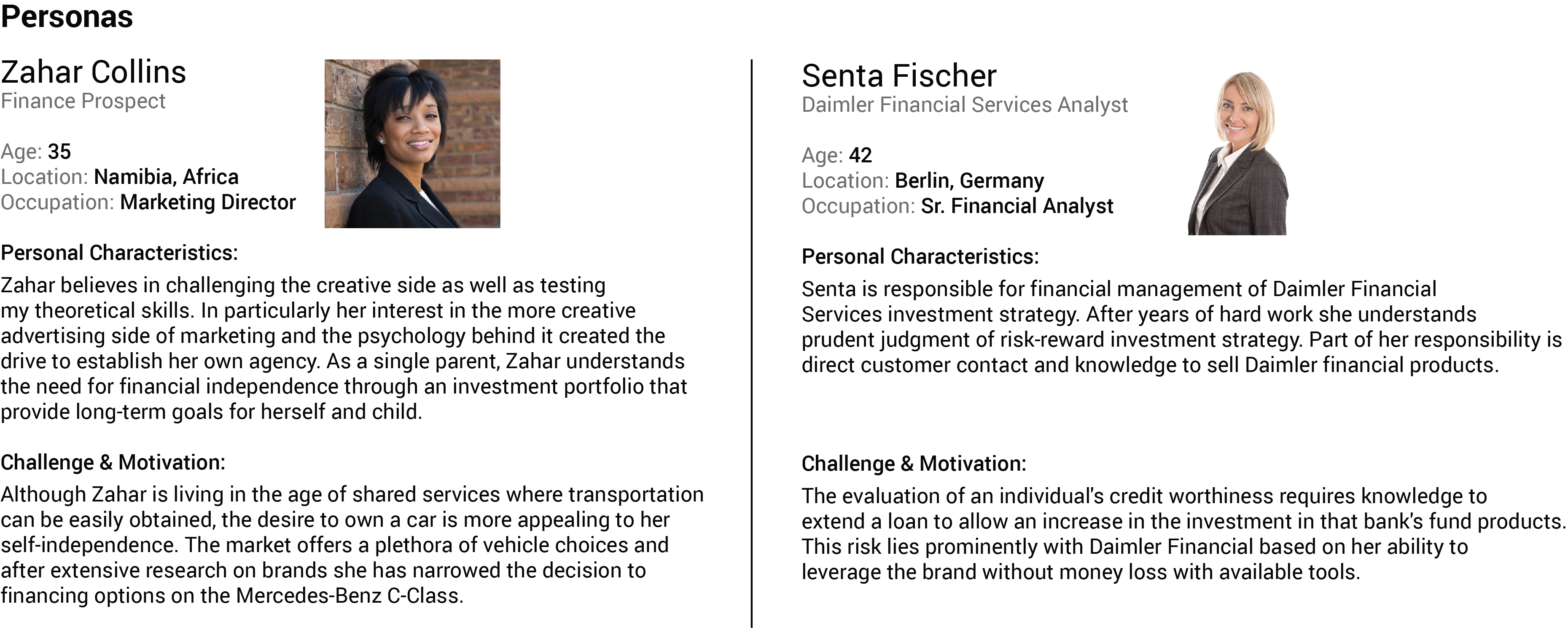

Persona Development:

The personas developed for this conceptual design were based on a typical customer seeking a creative financing for a vehicle purchase and the financial service analyst.

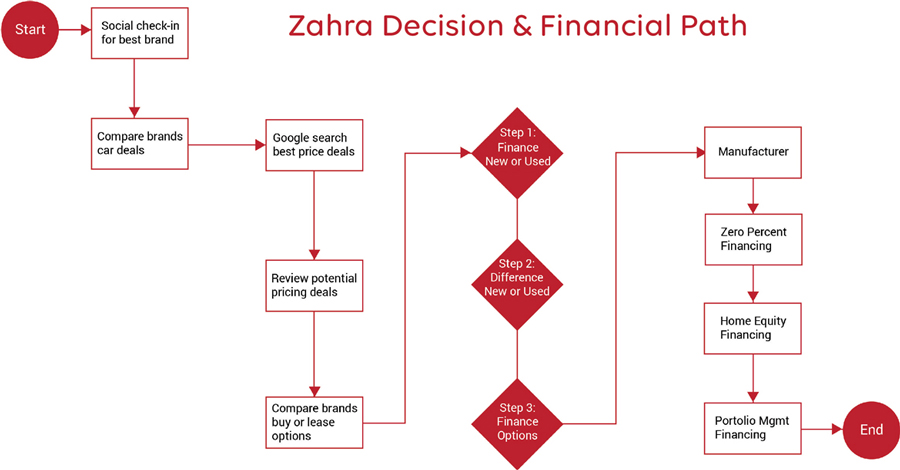

Zahra Flow Diagram

Zahra is typical for millennial behavior in that she built wealth as a result of owning a small business. Her investments into real estate and reliance on social networks for content, product reviews, opinions and referrals provided opportunities to improve her financial health.

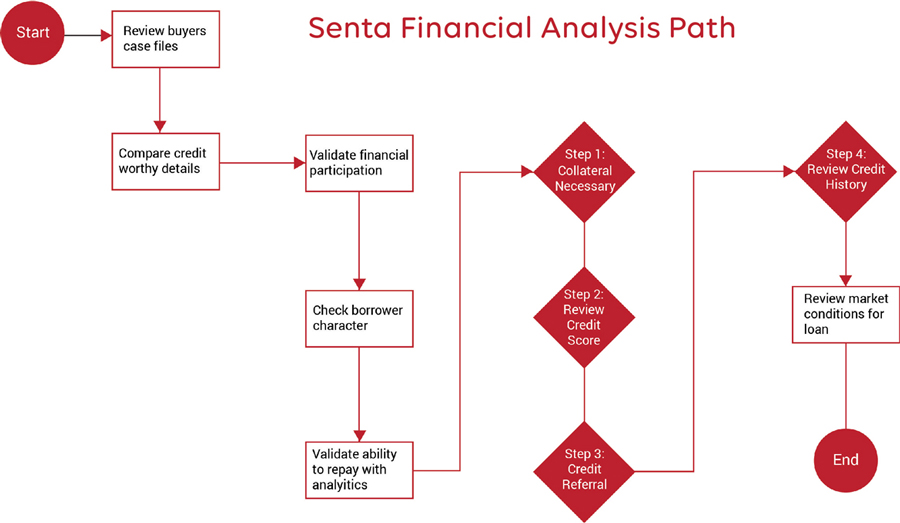

Senta Flow Diagram

The financial review process Senta used is linear because an analyst is required to verify data credibility before a loan can be issued. As the future continues to evolve, the best practice evaluation may utilize alternative methods.

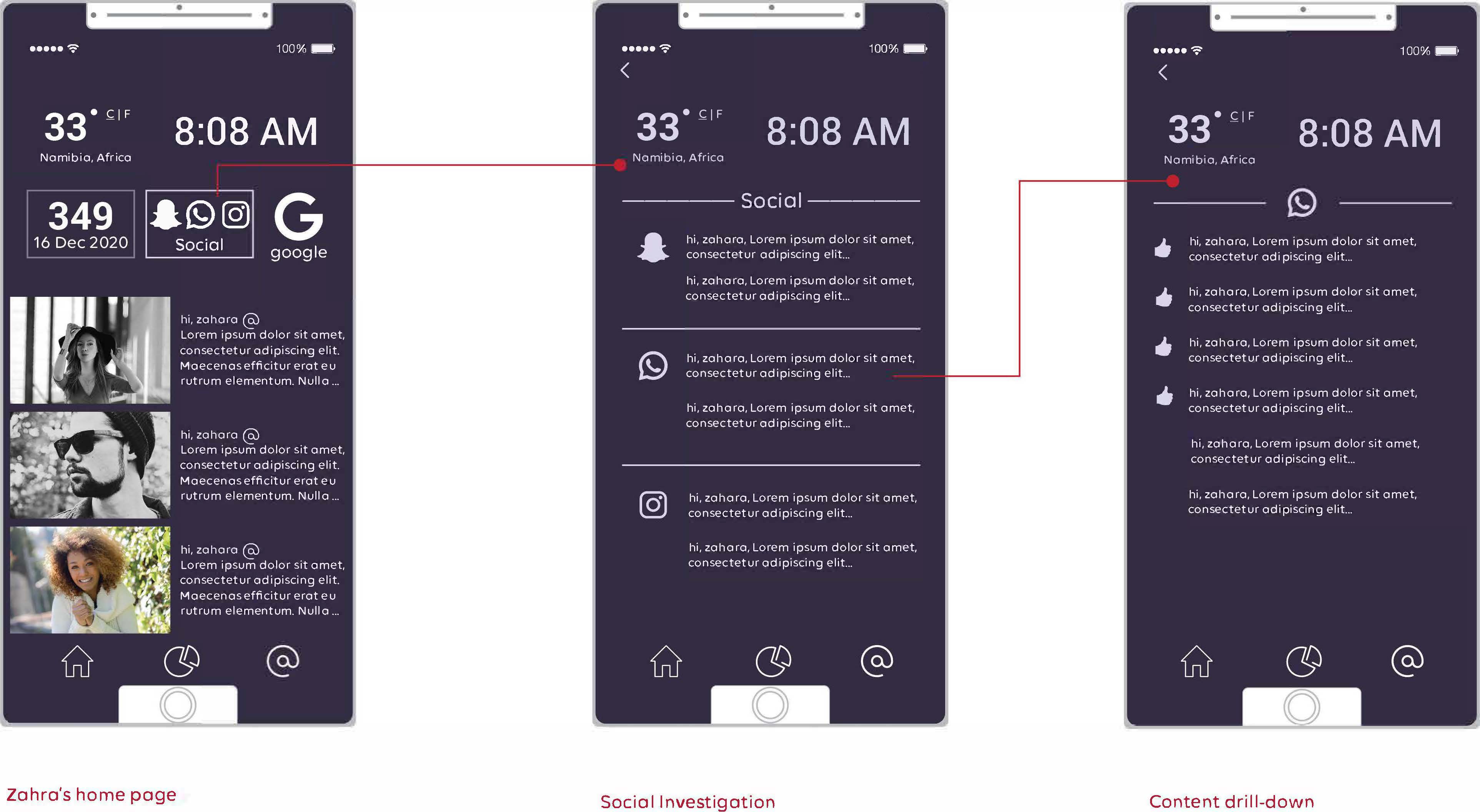

Wireframe Smart Device Flow

As illustrated in the below views, Zahra’s progression into social media to research opinions and product ratings before proceeding with a big-ticket item purchase is a typical buying practice.

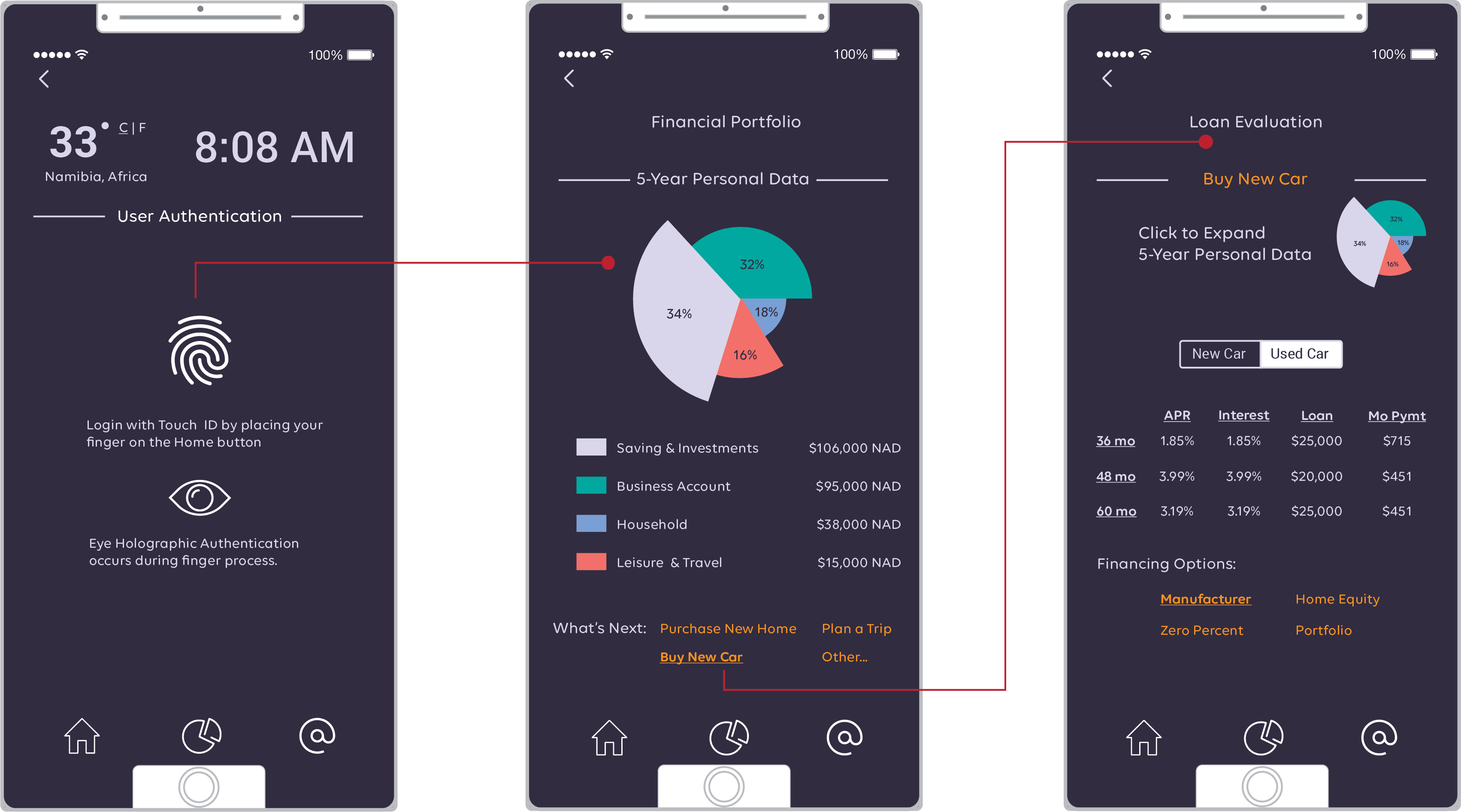

Wireframe Smart Device Flow Continue

At this stage of Zahra’s decision making, personal authentication into her available financial resources. This digital wealth management view provides insight into cloud financial data records shared across multiple financial institutions. Once complete, Zahra can share this information with the financial analysts of her choice.

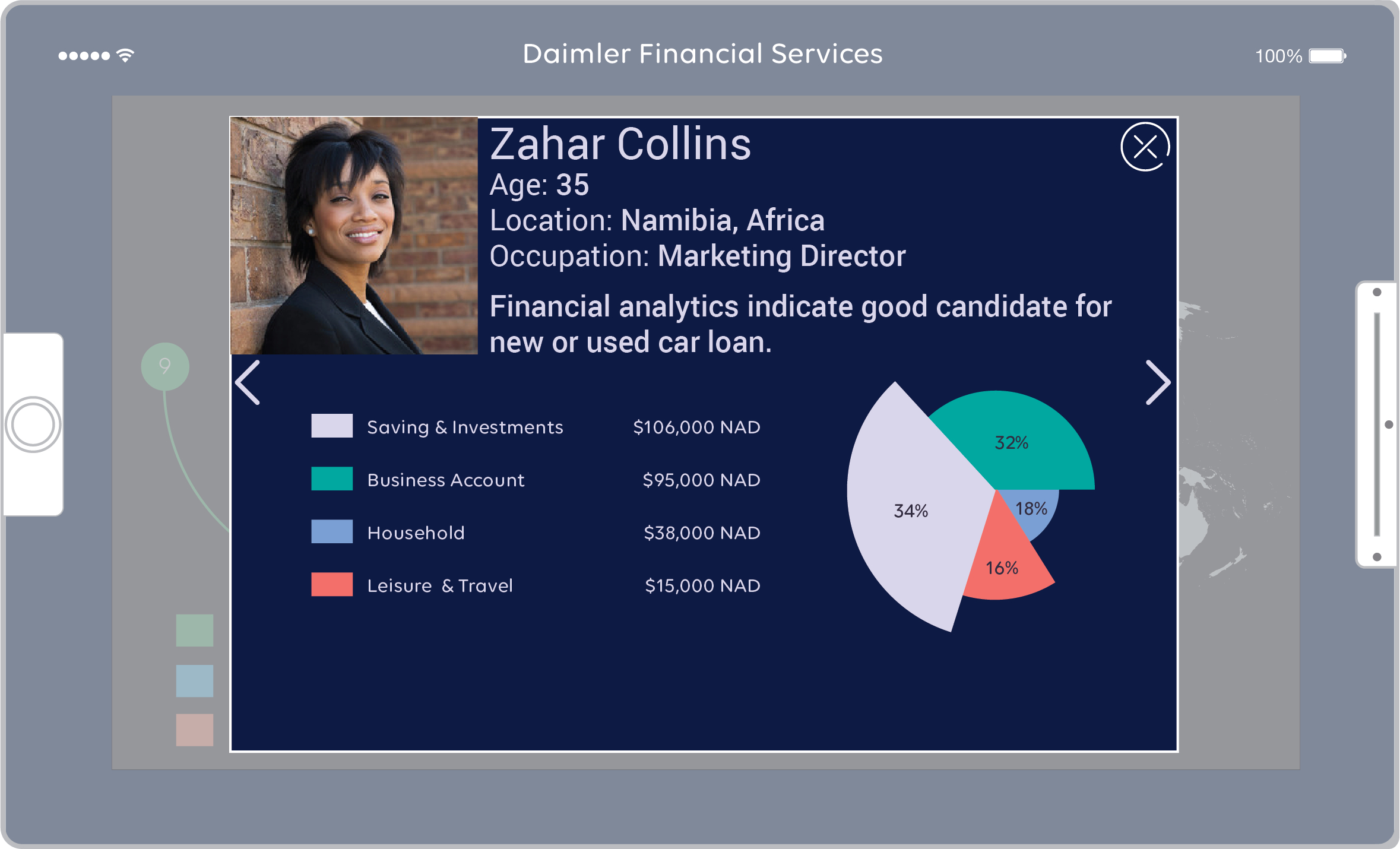

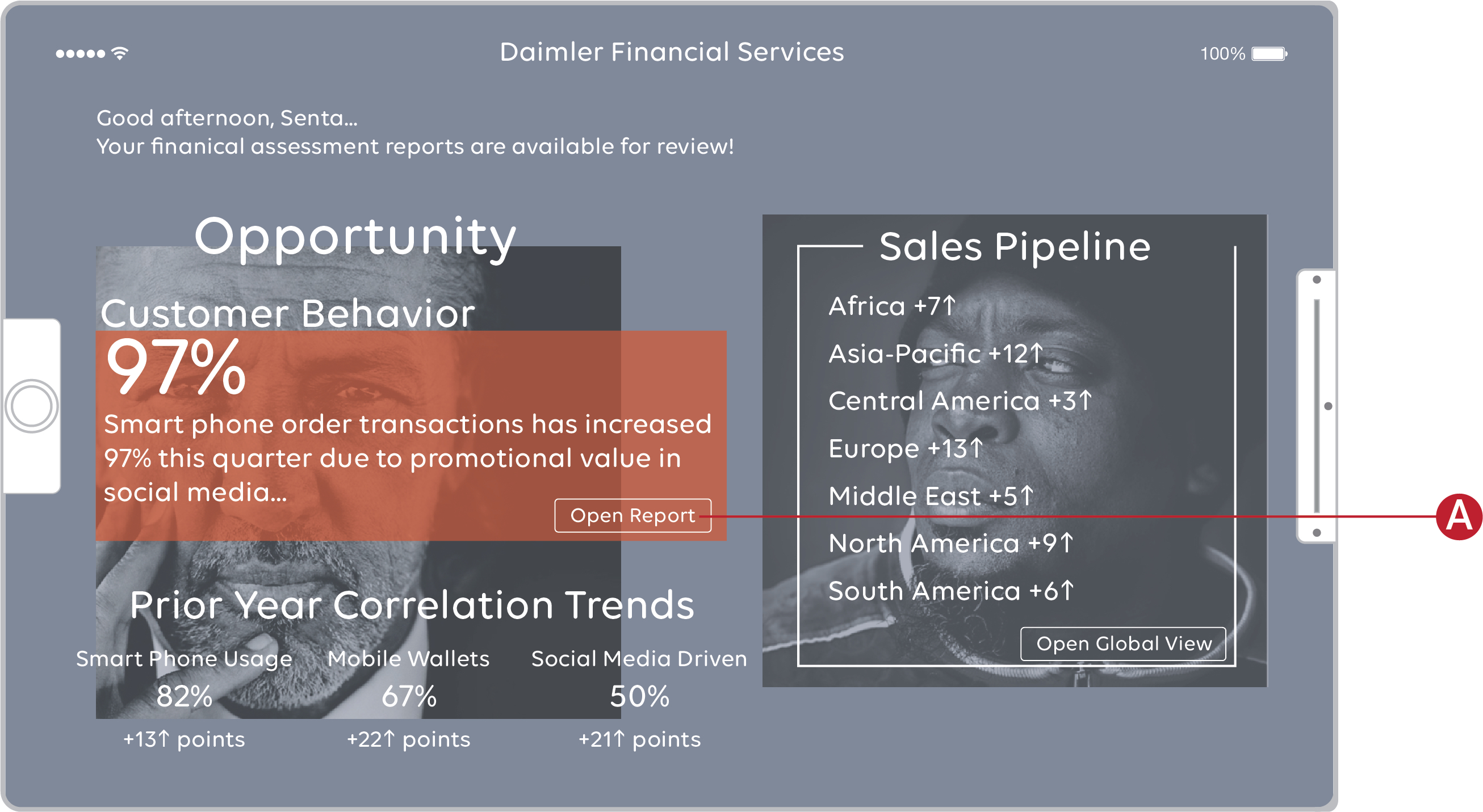

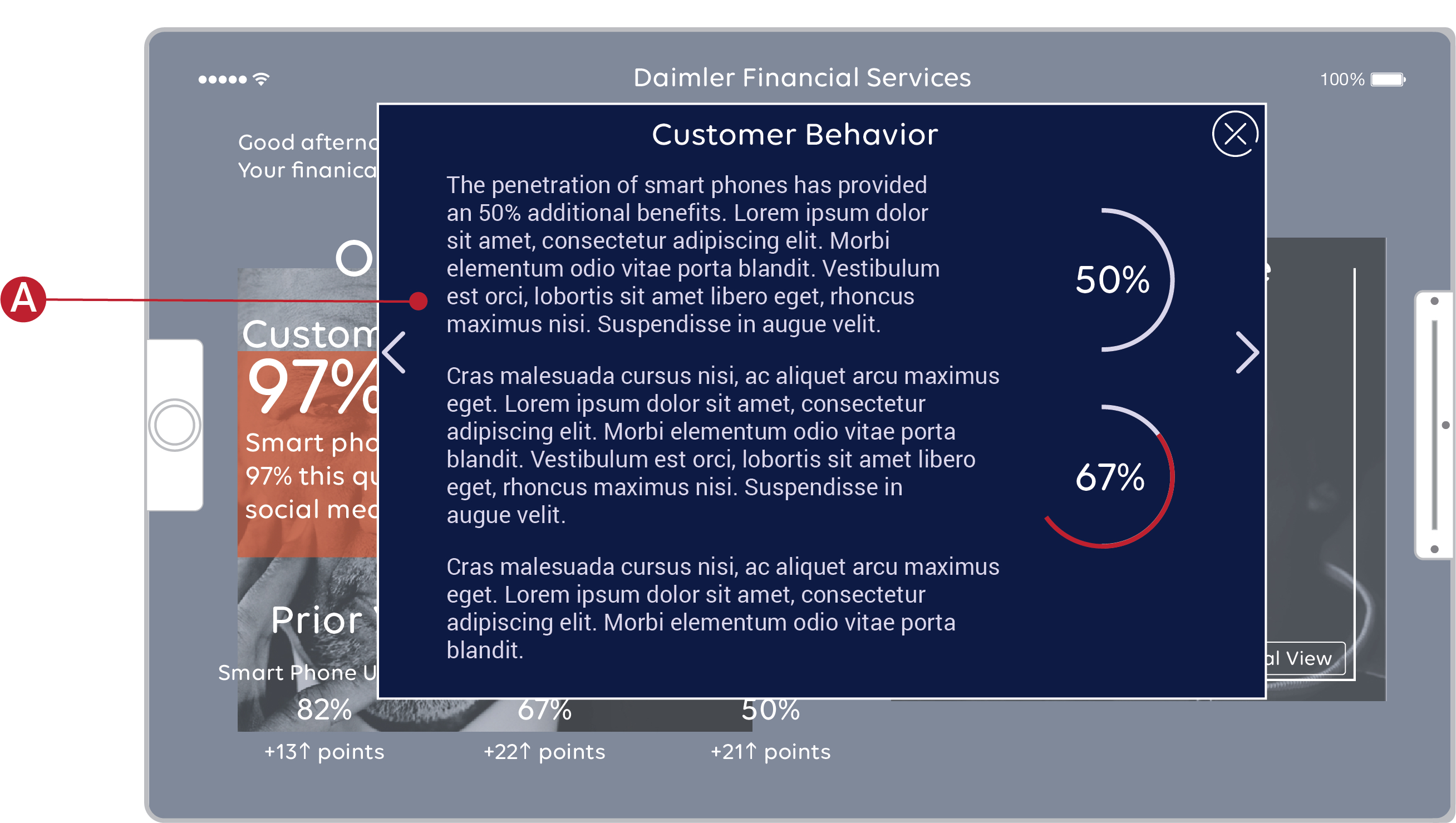

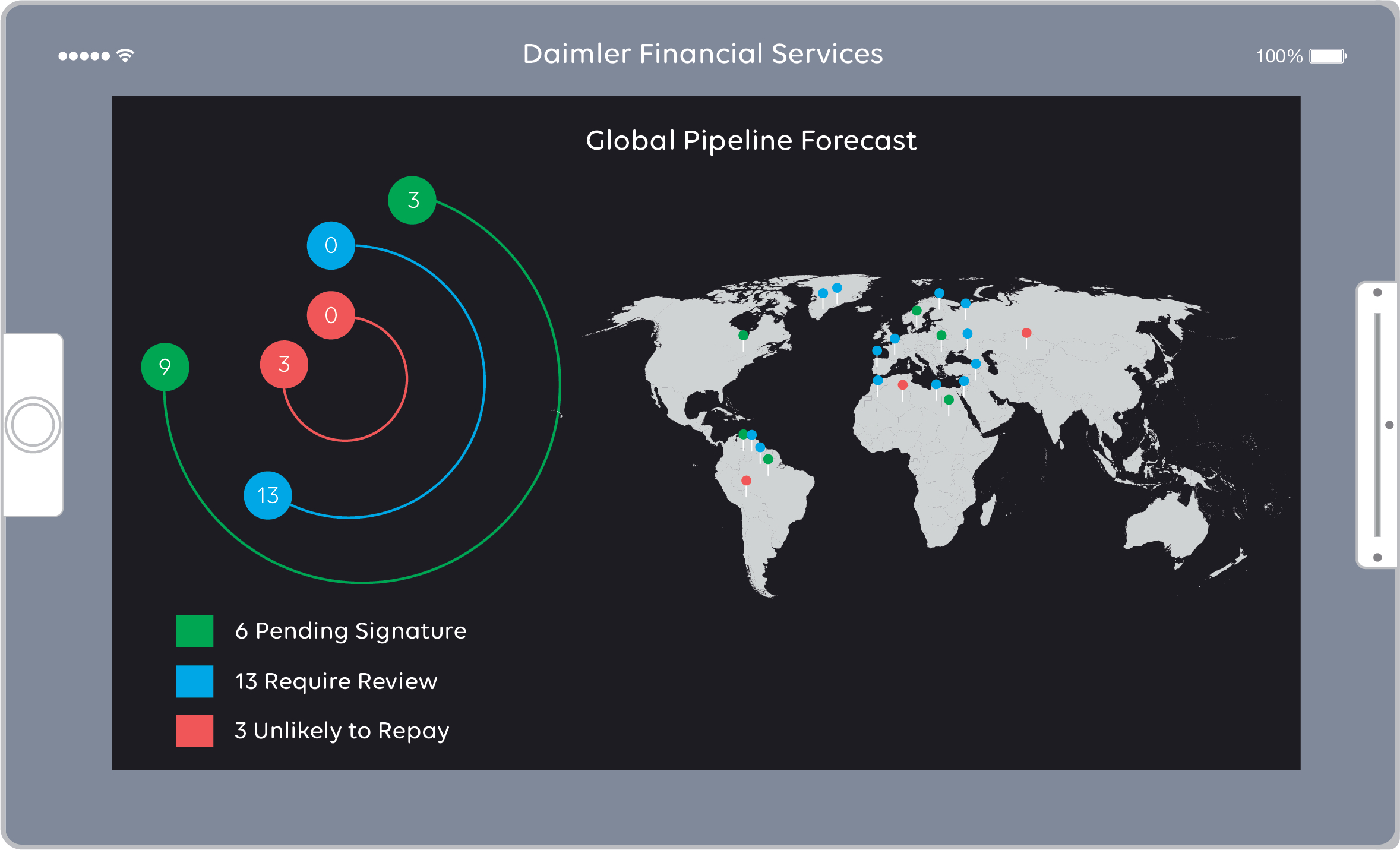

Financial Analyst Tablet View

At this stage of credit evaluation, Senta can review transaction behavior across a wide variety of metrics. Each page division provides the capability to drill-down for additional datapoints. In this wireframe the Open Report button advances the view to the following content.

Financial Analyst Tablet View (Cont)

Senta can review the content associated with Open Report button advancement.

Financial Analyst Tablet View (Cont)

Senta can review the content associated with the left and right content advancement.

Financial Analyst Tablet View (Cont)

Senta can review the loan candidate request for new or used car funding. Zahra posted her digital content for financial analytics to seek best-case loan scenario.